Many auto body shops in British Columbia are announcing increased waiting times for repairs. What is causing this backlog, and what does this mean for the industry?

by David Ribeiro

“I can’t find someone to take in my car for repairs,” many B.C drivers are saying. The Automotive Retailers Association (ARA) has urged industry members to speak with their local MLA about the current challenges facing the industry in this province.

Many local politicians are reportedly unaware of the challenges and limits that have been artificially imposed on industry. Surprisingly, consumers are also getting involved. Some of them have even approached their MLAs wondering why they cannot get their car into a repair shop. The obvious answer is increased volume, but certainly we have had winter before and never experienced this type of backlog, so what is up? This is the question that we asked our collision and glass industry members around the province, and 152 shops participated in the survey, and here is what they had to say.

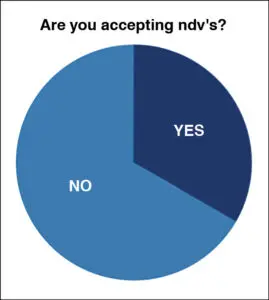

On the issue of wait times, glass service levels are significantly faster than collision repair service levels. Sixty-five per cent of glass service customers are able to attend a facility within one week, and approximately 85% of customers can get their glass issue resolved within two weeks. In contrast, only 9% of collision repair shops are able to service a drivable claim within two weeks, and 68% of shops have indicated that it would take two months or longer to service drivable claims. For larger, non-drivable claims, 70% of shops have indicated that the wait time will be at least two to seven months, with 67% of shops simply stating they are “not taking non-drivable claims at this time,” and 17% of shops are unsure if they ever will.

So, what is causing this backlog? Industry responses varied, but a general theme emerged. When asked to comment on the major factors affecting their ability to provide more timely access (in order of importance), shops stated the general reasons as follows:

- 59% – staff shortage

- 54% – shop at capacity

- 44% – lack of compensation

- 27% – parts backlog

- 12% – priority given to driveable claims

- 11% – insurance company policy and /or delays

Underfunding, Delays, and Workforce Shortages

The overwhelming comment from industry relates to the chronic underfunding of shop compensation levels, which has made it difficult for shops to recruit staff or compete with other higher-paying trades. The parts backlog certainly plays a role too, but industry has emphasized that the additional profit generated by larger, non-drivable claims has been eaten up by the added administrative burden carried to manage the claim, from repair planning and parts procurement to the cost of providing transportation services to the customers without purchased Loss of Use coverage. This has left many shops to focus on drivable losses, which require less administrative effort and have less financial impact since they do not have to provide replacement vehicle services.

We asked Industry to identify the specific factors that have affected their ability to service non-drivable claims. Besides the obvious, 73% affirmed that delays are a result of under compensation and the aforementioned inability to draw persons into the trade, and 65% implicated the alternate transportation service program (which B.C. shops are required to participate in) as a cause of delay, given many shops report losing money administering the program. Nearly 50% of respondents also stated that insurance programs and policies were also causing delays, from waiting for authorizations to simple delays in having a vehicle towed. Shops also commented on an increased level of pressure from their insurance partner.

It would appear that in B.C. we have hit an equilibrium shift. We now have too many claims for the volume of technicians in the industry. This concern has been raised by the ARA and substantiated through a Labour Market Report completed at the end of 2016. At that time, the forecast was a loss of 42% of the workforce by 2026 (31% due to retirement, 55% for other reasons, and 14% for new positions).

Also at that time, two longer-term strategies were identified to rectify the situation: (1) to improve the image of the auto sector, and (2) to review the role compensation schemes have on attraction and retention.

During the past five years, the ARA has develop and expanded its AutoCareersBC program, which works to shift perceptions at the school level and promote careers within the automotive industry. We are also working in partnership with ICBC to promote apprenticeship in the collision trade. Compensation levels have been a strong focus as well, with appeals to our main insurance partner and government. In this case, being correct is not a victory, just a recognition that insurers carry a large responsibility for the current shortages and resulting backlogs. The ARA continues to work with both the government and insurers to recognize how industry needs to grow in order to thrive; industry has done its part.